The Cash Book

In simple terms, this is an account that records all transactions of an individual or business involving the inflow or outflow of cash either physically or cash kept at the bank.

The Bank Statement

A statement prepared by a bank for a customer indicating amounts deposited and withdrawn from the customer's account within a period of time

Both accounts are related and the double entry for a transaction in one account must reflect in the other account. Whenever a customer receives money through his bank account, His Cash Book is debited with the amount and the Bank Statement is credited to the tune of that amount. The opposite happens when money moves out of the Bank Account of a customer- the cash book is credited and the Bank account credited. If there are no discrepancies upon comparing both accounts then there will be no need to reconcile the accounts. But in most cases, both accounts will have different balances normally due to some errors from either side of the party.

Whenever cash moves in and out of a customer's bank account, records are made by that customer and at that same time the bank will also be recording the flows of cash into and out of the business bank account. Banks usually send a copy of that record, called a bank statement, to their customers on a regular basis, but a bank statement can be requested by a customer of the bank at any time.

What causes the Balances to Differ?

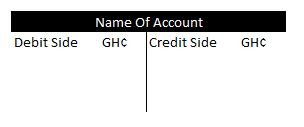

Let us carefully examine the sample Cashbook and Bank Statement above to understand our topic.

We can see that there are some items in the cash book that do not appear in the Bank Statement and other items in the Bank Statement that do not also appear in the Cash Book.

Items Not appearing in cash book

- Bank Charges - GH¢50

- James Korlet-Direct Credit-GH¢150

Items Not Appearing in the Bank Statement

- Frank Lim-GH¢250

Obviously, our closing balances are not the same as well.

The items listed above are some of the reasons why our balances do not agree on both the cash book and the bank statement.

Let's try to identify why these items could not be found in the other account, could it be an oversight? Or there's more explanation to that? We'll see about that soon.

So on the first item "Bank Charges" This could not be found in our cash book although our bank has charged it against our account. These charges are usually done at the end of the period and the customer does not usually know how much is being charged by the bank for all services rendered. In some cases, you might even think some services rendered by the bank are for free until you see it being charged against your account. When the bank charges us, it may not send an invoice, it simply takes the money from our account. In cases like this, our cash book will tell a different story from the bank statement.

The second item being a Direct Credit is also not in our cash book. This kind of transaction occurs when our debtors or anyone at all directly sends money into our account without informing us. In this case, we will not know of such transactions but our bank who knows of it credits the amount in our bank statement.

The third item bearing the name of a person "Frank Lim" does not appear in the Bank Statement. It could be that the bank forgot to add that particular transaction or we recorded it wrongly in our cash book. In most cases, what happens is that we give out a cheque and then its rejected by the bank, When this occurs and the person to whom the cheque was given does not inform us, we assume that we've paid that person and as such appears at the credit side of our cash book. But because the Bank rejected the cheque, it does not make any entries into the Bank Statement.

Moving away from the examples in the image, there are some other instances that will make our balances differ.

Unpresented Cheques: A cheque can be given to a customer but then this customer does not go to cash the cheque. Maybe he does that after the period our bank Statement is given to us. In this case, the amount on the cheque will appear on the Cr. Side of our cash book but will be found nowhere in the bank statement.

Bank Interests: This also causes a similar effect to that of bank charges, the amount of interest paid may not be known by the customer and even the bank might not give any document to the customer immediately such interest has been paid. In some cases too, the customer may know of the interest to be paid but not the exact amount. So if the customer fixes an estimated value in his cash book, it will probably be different from what is in the Bank Statement.

Standing Orders: These are instructions from the customer to the bank to undertake certain transactions on behalf of the customer, the customer does not know when these transactions will actually be performed by the bank and as such may not record a transaction which the bank has performed or the customer may record a transaction which has not yet been performed by the bank and not in the Bank statement.

Direct Debit: This is the exact opposite, with direct credit, money is moving into your account without your knowledge but with direct debit, money moves out of your account and could be that you're unaware of the actual amount until it has been shown in the Bank Statement. The difference between this and standing order is that a direct debit is a permission given by the customer to his creditors to obtain money directly from his(customer) account whereas a Standing order is an instruction by the customer. IN the case of direct debits, the bank will have to charge whatever amount the customer's client need to charge from the customer's account. But the customer must inform the bank of the amount he wants the bank to charge to his account in the case of standing order

Dishonored Cheques: A cheque dishonored is a Cheque drawn by a customer for which the Bank refuses payment for some reasons. When this happens, the customer might have left his cash book with that amount of the cheque dishonored whiles the Bank Statement will show no such records because the cheque was rejected. Some of the reasons for rejecting a cheque include;

- Insufficient funds

- Insufficient mandate

- Amount in words is different from amount in figures

- No signature of account holder

- Signature difference from bank specimen

- Postdated Cheque

- Stale Cheque

Errors: We cannot do away with errors as humans and as such there could be some errors coming from the side of the bank or errors made by the customers. Both parties must work together to be able to sort out such errors when identified. It could be that some figures have been overstated, understated, left out of the accounts or on the wrong side of the account.

How to Reconcile

We'll have to examine both accounts and identify the errors in each and correct them with information available.

Correcting the Cash Book

By comparing our Cashbook to the bank statement, we would have realized some errors or omissions from our side, these need to corrected by opening an "Adjusted Cash Book". This account will contain balances from the initial Cash Book as well as adjusted entries to correct errors or record omissions from the initial Cash Book. Thus, you debit whatever was supposed to be debited and credited what was to be credited but was left out in the original cash book.

Some Errors or Omission in the Cash Book may arise from;

- Payments made directly into our bank accounts without our notice and not entered in the Cash Book

- Dividend received (e.g. from Investment) paid directly into the bank accounts but not in the Cash Book

- Bank Interest(e.g. from savings account) & Bank Charges(e.g. from ATM Charges) not entered in the cash book

- Other errors such as overcast & undercast

Other Errors or Omissions may also be found in the Bank Statement, these include;

- Cheques drawn by customers but has not yet been presented to the customer's bank for payment. In this case, the amount will appear in the Cas Book only since the bank is unaware of such transactions until it has been presented for payment. These are known as Unpresented Cheques

- Also customers may receive cheques from other people for which the Bank is yet to show the effect of it in the customer's account. In tha case, such amounts will only appear to be in the Cash Book only and not in the Bank Statement since it is yet to be cleared and entered in the account by the Bank,=. These are known as "Uncredited Cheques".

Just as we did initially, you'll have to compare both statements. Identify which figures appear in both, which ones do not appear in either and that's where the work begins. For examination purposes you might be told what circumstances led to the differences in the balances, in that case, your work becomes a but simpler, Let us take a look at such instance from this illustration.

The cash book of Lexis Limited as at 31 December 2016 discloses a balance of GH¢18,450 which did not agree with the bank statement balance. Investigation revealed the following:

- Cheques received of GH¢52,000, GH¢5,000 and GH¢12,450 were still in the business drawer.

- GH¢1,200 and GH¢1,800 standing orders for the payment of Electricity charges and Insurance respectively were paid by the bank but this has not been recorded in the cash book of Lexis Limited.

- The bank charged GH¢150 for a cheque book issued to Lexis Ltd.

- The bank has wrongly debited a cheque of GH¢4,955 into Lexis Ltd account which should have been placed in another customers account.

- A credit transfer of GH¢5,000 had been made in favour of Lexis Ltd. The transfer has not been recorded in the cash book.

- A cheque of GH¢70,000 drawn by Lexis limited was correctly entered in the cash book but debited to the bank statement as GH¢7,000

- The following cheques which were paid in November 2016 had not been presented

| Cheque Number | GHS |

| 00001168 | 5,000 |

| 00001190 | 4,655 |

| 00001142 | 2,000 |

Required: Prepare the;

- The adjusted cash book

- A statement to reconcile the balance in (i) above to the bank statement balance

Solution

In the preparation of the Bank Reconciliation Statement, we needed to correct errors that affected the Bank Statement as well as including our Adjusted Cash Book Balance. Errors that affect the Bank Statement either increase or decrease our Balances, so we sum up all errors or omission from the Bank Statement that makes our account appear to have a higher Balance (NB: Balance from the Bank Statement and not Cash Book) and then we add it to the Adjusted Cash book Balance.

We then subtract the summation of items that makes our balance in the Bank Statement appear to be less.

Normally, items that make our Balances in the Bank Statement appear to be higher are;

- Unpresented Cheques- Because the customers have not yet presented them to the bank and as such the bank has not made any deductions.

- Wrong Credit: An error that makes the credit side of the Bank Statement higher than what it is supposed to be.

Items that make the balances in the Bank Statement to be lower include;

- Uncredited Cheque- Because the bank has not recorded that these cheques have been deposited into our accounts.

- Wrong Debit- Errors that make the debit side of the Bank Statement higher than what it is supposed to be.