Source documents

They are forms of evidence to prove that some transactions took place for which there is a need to record into the books of accountsHere are some source documents for recording transactions;

- Invoice

- Receipts

- Credit Note

- Debit Note

- Purchase Order

- Sales Order

- Quotation

Invoice Vs. Receipt

One major difference between the two is that a receipt is issued after payments have been made. The invoice is just a statement of goods sent or services provided, together with the costs or sum of monetary value for these goods and services. The invoice relates to a sales order or purchases order. On the contrary, receipt acts as documentation for the buyer that the amount of the goods has been paid.Receipt relates to cash sales. In short, a receipt is proof of payment whereas invoice is a list of goods and services and their prices to be sent to the company requiring those goods or services.

Invoices are usually issued when there is a credit sale, the invoice tells the debtor how much he owes the credit, the debtor will then pay according to the amount on the invoice issued to him. After this payment, after this payment, the "debtor" will no longer be liable and will now be given a receipt.

There will be no need for an invoice for cash sales.

More on Invoice: Most invoices are numbered so that companies can keep track of all invoices sent and also to accountant for their debtors.

Debit Note Vs. Credit Note

Both documents are used when the return of goods are being made. When a business issues a debit note, it means it is returning goods outwards and as such the debit note being issued indicates the other business is receiving; Like in the basic accounting class where we are told to” debit the receiver and credit the giver”. With this said, receiving company will also give out a credit note to the company returning the goods. The issue of the credit note indicates that the other company(returning) the goods is the “giver”

Quotation

This is a document sent to a customer stating the fixed price that would be charged to produce or deliver goods or services. Quotations are normally used when there are no fixed or standard prices to produce or deliver goods or services. Thus when the skills, materials and time required vary according to the customer's needs. This document is very similar to an invoice, but in this case, the buyer has not yet received any goods or services from the seller. In fact they seller may even decide not to buy from the buyer after receiving the quotation.Sales Order Vs Purchase Order

The Purchase Order is a document with details of goods and service that a company wishes to purchase from another company, whereas Sales Order is a document with details of an order that has been placed by a customer.A Journal

A journal is a more detailed record of financial transactions in order by date. It is detailed in the sense that it includes an explanation of each transaction. The records in journals do not end there but are later posted to other accounting books such as a ledger. It is often referred to as the Book of Original EntryTypes of Journal

- Purchase journal

- Sales journal

- Cash Book

- Purchase return journal

- Sales return journal

- Journal proper/General journal

You should note that the cash book falls under the category of both journals as well as a ledger.

We will now discuss each Journal a bit in details:

Sales Journal: It is used to record credit sale of goods only. Cash sale of goods is recorded in cash book. A credit sale of an asset is recorded in general journal.

General Journal: It is used to record any other transaction that does not fall into any category of journals listed above.

The following are some uses of the General Journal:

The following are some uses of the General Journal:

- To record rare transactions, eg. Sale of Non-Current Asset, Writing off bad debts

- Correction of errors

- Adjusting entries

- Opening Entries - When a businessman wants to open the book for a new year, it is necessary to journalize the various assets and liabilities before the new accounts are opened

- Closing Entries - When the books are balanced at the close of the accounting period with a view to preparing final accounts it is necessary that balance of all the income and expenses accounts must be transferred to trading and profit and loss account.

- To record transactions that cannot fit into any other journal

- Distribution of goods as a free sample

- Distribution of goods as charity

- Goods stolen by employees.

- Exchange of one asset for another asset

- Goods destroyed by fire.

Importance of keeping Journal Accounts

- Each transaction is recorded as soon as it takes place. So the possibility of any transaction being omitted from the books of account is minimized.

- The Ledger is kept tidy and brief because the transactions are kept and recorded in journal chronologically with narration, it can be easily ascertained when and why a transaction has taken place.

- Any mistake in the ledger can be easily detected with the help of journal.

- Journals show the complete details of every transaction

What you Should Note when making Journal Entries

- Date on which the transaction occurred

- The account to be debited and the corresponding monetary value

- The account to be credited and the corresponding monetary value

- A reference(Source Document) to the source document that initiated such entry. Example invoice or credit note

- A reference of the ledger in which entry is posted. Usually, a separate column is maintained with the name “folio”

- A short narration of transaction that tells you what transaction was about.

We have already seen the first step in the process if recording transactions, Now we have to look at methods to summarize them: Using Ledgers and Double entry

A ledger

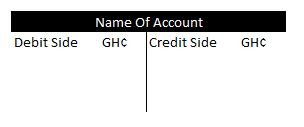

A ledger is simply a book for recording business transactions measured in terms of money. Transactions in the ledger are summarized and act as a central repository of information for the accountant. Most people refer to the ledger as the general ledger.Types of Ledgers:

- Subsidiary Ledger: this consists of the;

- Sales ledger- for the personal accounts of customers

- Purchases Ledger- for the personal accounts of suppliers

- Main(General) Ledger: The main ledger takes account of all other transactions

Trade Discounts Vs Cash Discounts

Trade Discount is a deduction from the retail price and normally arises from bulk sales. Whereas Cash discount refers to the value deducted from the total amount that was supposed to have been paid by the purchaser. Cash discount is a deduction from the invoice price and it serves as a motivation for the purchaser to pay the amount due within a specified time Trade discount is not recorded in the books of account because it does not bring any financial change of seller or buyer.Records of Trade Discounts are only made on the invoice.

Let's make these definitions a bit basic for ourselves; Let's say you bought goods worth USD100,000.00 but then the seller has made arrangements for you to pay only USD98,000.00 out of the initial price; the rest of the USD2,000.00 is for you to keep; in such a case like this, the buyer has received a Cash Discount.(A discount on the actual amount he was supposed to pay.

Here is another case, a buyer walks to a shop and it's displayed on the prices of the products that there's a discount of say 20%. In this case, the cost of the product is now 80% of the original cost. This is the decision from the seller and not in consultation with the buyer and does not affect the payment of the total amount due. This is a Trade Discount

Also both documents serve different purposes; A trade discount is usually meant to encourage buyers to make bulk purchases, whereas Cash Discounts; to speed up payment by the buyer.

0 comments:

Post a Comment